What Type Of Account Is Office Supplies Expense . the debit account for accounting materials and office supplies is an expense account. Therefore, this account will appear in the. when the supplies are used, they are recorded as an expense by debiting the expense account and crediting the. supplies expense refers to the cost of consumables used during a reporting period. They can be categorized as factory. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. office supplies expense is the amount of administrative supplies charged to expense in a reporting period.

from www.chegg.com

office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. Therefore, this account will appear in the. They can be categorized as factory. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting. when the supplies are used, they are recorded as an expense by debiting the expense account and crediting the. supplies expense refers to the cost of consumables used during a reporting period. the debit account for accounting materials and office supplies is an expense account. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply.

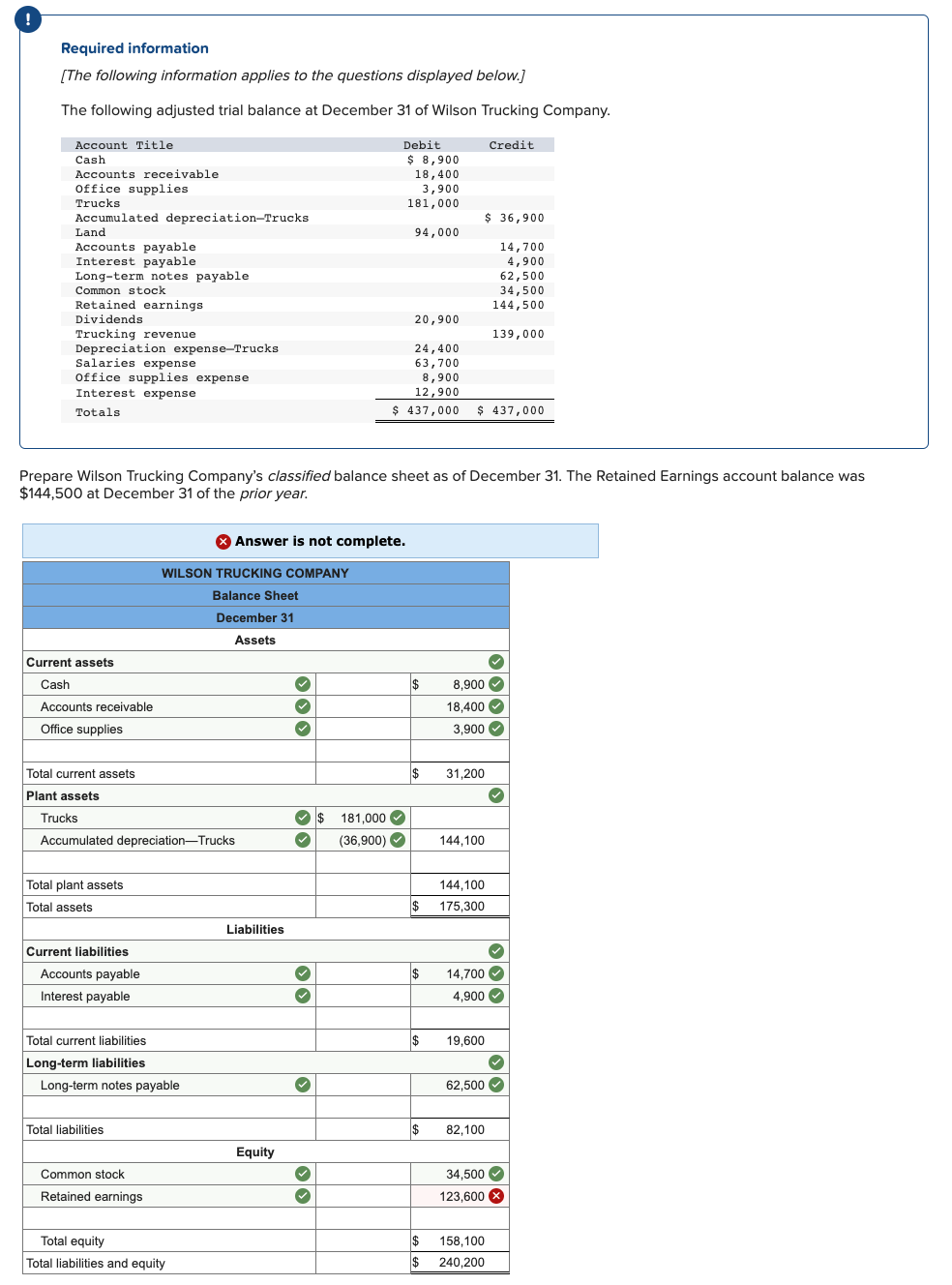

Solved ! Required information [The following information

What Type Of Account Is Office Supplies Expense in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply. They can be categorized as factory. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Therefore, this account will appear in the. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. the debit account for accounting materials and office supplies is an expense account. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting. when the supplies are used, they are recorded as an expense by debiting the expense account and crediting the. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply. supplies expense refers to the cost of consumables used during a reporting period.

From www.bartleby.com

Answered Earnings, Supplies, Accounts Payable,… bartleby What Type Of Account Is Office Supplies Expense office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can. What Type Of Account Is Office Supplies Expense.

From www.myaccountingcourse.com

What is Selling, General & Administrative Expense (SG&A)? Definition What Type Of Account Is Office Supplies Expense in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. when the supplies are used, they are recorded as an expense by debiting the expense account. What Type Of Account Is Office Supplies Expense.

From www.chegg.com

Solved Valley Company's adjusted account balances from its What Type Of Account Is Office Supplies Expense the debit account for accounting materials and office supplies is an expense account. Therefore, this account will appear in the. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting.. What Type Of Account Is Office Supplies Expense.

From www.tianseoffice.com

6 Simple Ways On How To Reduce Office Supply Expenses Tianse What Type Of Account Is Office Supplies Expense the debit account for accounting materials and office supplies is an expense account. Therefore, this account will appear in the. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting.. What Type Of Account Is Office Supplies Expense.

From db-excel.com

Business Expense List Template — What Type Of Account Is Office Supplies Expense the debit account for accounting materials and office supplies is an expense account. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. They can be categorized as factory. Web. What Type Of Account Is Office Supplies Expense.

From doctemplates.us

Expense Form Excel Expense Report Template In Excel DocTemplates What Type Of Account Is Office Supplies Expense companies can record office supplies as expenses when they do not expect the supply to last more than one accounting. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply. Therefore, this account will appear in the. when the supplies are used,. What Type Of Account Is Office Supplies Expense.

From www.chegg.com

Solved The following Office Supplies account information is What Type Of Account Is Office Supplies Expense office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply. They can be categorized as factory. supplies expense refers to the cost of consumables used. What Type Of Account Is Office Supplies Expense.

From www.spendesk.com

Definition & Types of Expense Accounts Spend Management Glossary What Type Of Account Is Office Supplies Expense when the supplies are used, they are recorded as an expense by debiting the expense account and crediting the. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. They can be categorized as factory. Therefore, this account will appear in the. in the case of office supplies, if the. What Type Of Account Is Office Supplies Expense.

From www.chegg.com

Solved Office Supplies used during the month, 90. Date What Type Of Account Is Office Supplies Expense Therefore, this account will appear in the. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply. when the supplies are used, they are recorded as an expense by debiting the expense account and crediting the. office supplies expense is the amount. What Type Of Account Is Office Supplies Expense.

From db-excel.com

office supply expense report template — What Type Of Account Is Office Supplies Expense the debit account for accounting materials and office supplies is an expense account. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. They can be categorized as factory. Web. What Type Of Account Is Office Supplies Expense.

From www.akounto.com

Are Supplies an Asset? Understand with Examples Akounto What Type Of Account Is Office Supplies Expense office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. Therefore, this account will appear in the. They can be categorized as factory. the debit account for accounting materials and office supplies is an expense account. supplies expense refers to the cost of consumables used during a reporting period. Web. What Type Of Account Is Office Supplies Expense.

From www.etsy.com

Office Supplies Request Printable Form Business Expense Etsy What Type Of Account Is Office Supplies Expense supplies expense refers to the cost of consumables used during a reporting period. Therefore, this account will appear in the. when the supplies are used, they are recorded as an expense by debiting the expense account and crediting the. the debit account for accounting materials and office supplies is an expense account. office supplies expenses include. What Type Of Account Is Office Supplies Expense.

From www.pinterest.com

office supply budget template office supply budget template business What Type Of Account Is Office Supplies Expense office supplies expense is the amount of administrative supplies charged to expense in a reporting period. supplies expense refers to the cost of consumables used during a reporting period. Therefore, this account will appear in the. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting. Web. What Type Of Account Is Office Supplies Expense.

From www.sampletemplates.com

FREE 10+ Sample Lists of Expense in MS Word PDF What Type Of Account Is Office Supplies Expense when the supplies are used, they are recorded as an expense by debiting the expense account and crediting the. Therefore, this account will appear in the. supplies expense refers to the cost of consumables used during a reporting period. companies can record office supplies as expenses when they do not expect the supply to last more than. What Type Of Account Is Office Supplies Expense.

From www.chegg.com

Solved Santana Rey created Business Solutions on October 1, What Type Of Account Is Office Supplies Expense when the supplies are used, they are recorded as an expense by debiting the expense account and crediting the. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset,. What Type Of Account Is Office Supplies Expense.

From www.smartsheet.com

Free Small Business Expense Report Templates Smartsheet What Type Of Account Is Office Supplies Expense They can be categorized as factory. the debit account for accounting materials and office supplies is an expense account. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. supplies. What Type Of Account Is Office Supplies Expense.

From financialfalconet.com

Is supplies an asset? Financial What Type Of Account Is Office Supplies Expense supplies expense refers to the cost of consumables used during a reporting period. Therefore, this account will appear in the. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file. companies can record office supplies as expenses when they do not expect the supply to last more than one accounting.. What Type Of Account Is Office Supplies Expense.

From brainly.ph

CHART OF ACCOUNTS ASSET 101Cash 102Prepaid Rent 105Office Supplies What Type Of Account Is Office Supplies Expense companies can record office supplies as expenses when they do not expect the supply to last more than one accounting. when the supplies are used, they are recorded as an expense by debiting the expense account and crediting the. Therefore, this account will appear in the. the debit account for accounting materials and office supplies is an. What Type Of Account Is Office Supplies Expense.